Bridging loan how much can i borrow

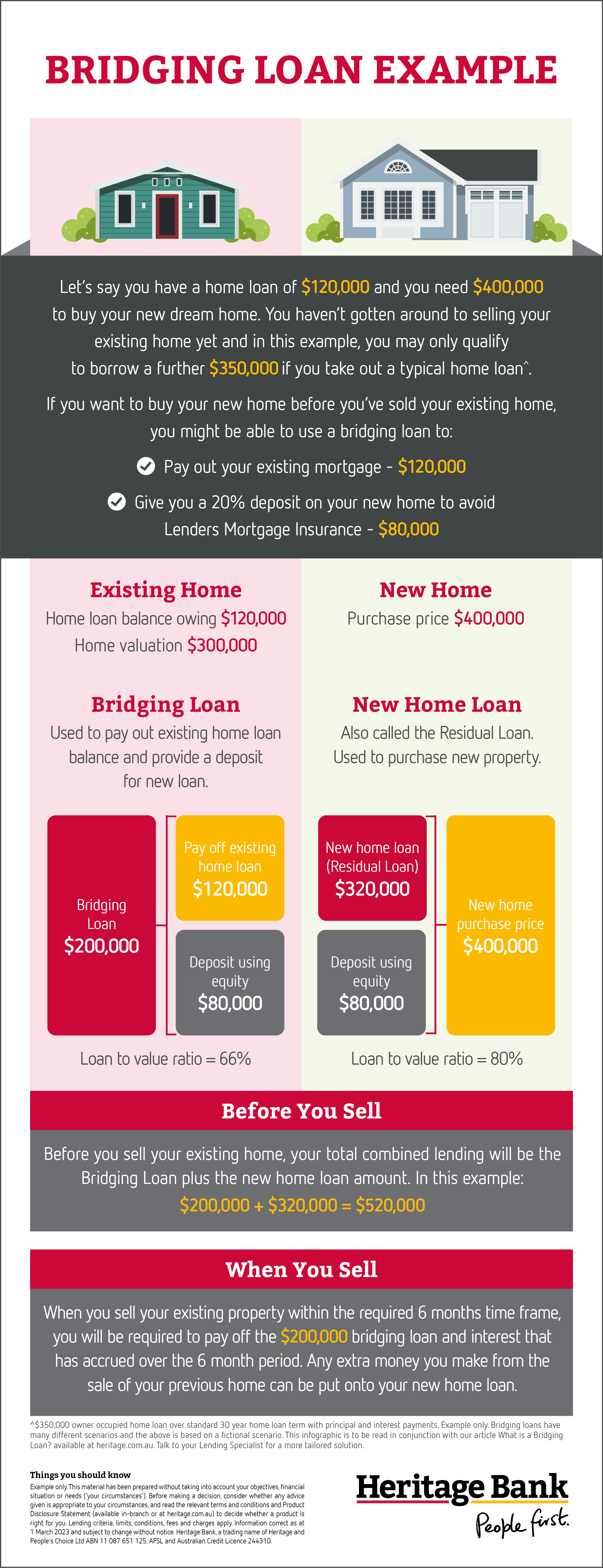

In cash terms bridging loan providers might lend anything between 25000 and over 25m. Whilst the LTV loan-to-value ratio will determine how much you can borrow up to our usual lending.

Casi Mata Plasticidad Bridging Loan Rates Calculator Voluntario Dinkarville Posada

Bridging Loan Interest Rates Standard LTV-based residential bridging loan interest rates are as follows.

. In many cases theres no strict upper limit and some bridging loans may run into millions of. Borrow up to 80 of the peak debt. Join 2 Million CA Residents Already Served.

Ad Apply if approved a business line of credit is ready whenever you need it. Arrangement fees also known as product fees or facility fee are charged by almost all lenders. Click Now Apply Online.

2 Years in Business 200k Annual Revenue Recommended for Largest Selection. If you need a bridging loan please call us on 1300 889 743 or complete our free assessment form and we can tell if you qualify. Apply and if approved Use Business Funding Today Tomorrow Anytime.

Ad Buy a new home with Knocks conventional mortgage equity advance bridge loan now. If you own the property outright and you have no loans secured against it. Bridging loans typically start from around R25000 but some lenders only offer larger sums.

But youll usually only be able to borrow a maximum loan-to-value ratio LTV of 75 of the value of. Summary of our guide of how to get a home equity loan. Applicants can ask for a loan amount between.

Bridging loans are a way to borrow money against the equity you have in a property. Annual Percentage Rates APRs can be anywhere between 6 and 20. 100 loan on the new property A bridging loan can allow you to borrow up to 100 of the purchase price of your new property plus the associated costs.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Research the laws in your state to find out if where you live will impact how much you can borrow from a title loan. Ad For CA Residents Get Payoff Relief for 15000-150K Bills Without Bankruptcy or Loan.

In comparison standard mortgages can be as cheap as 1 or 2. The maximum debt to income ratio borrowers can have is 50 on conventional loans. Apply and if approved Use Business Funding Today Tomorrow Anytime.

An interest-free bridge loan to leverage the equity in your home to buy a new one. BBB AFCC Accredited. Up to 50 LTV starting from 043 per month 50-65 LTV starting.

How Much Can you borrow with a Bridging Loan. Home equity loans allow homeowners to access as much as 80 or 85 of the equity in their home as a lump sum. 1 day agoLoan Amounts and APRs.

Our lenders offer loans from 50000 to 15 million. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. If you are looking for a loan lower than this then you may.

If you still have a mortgage on a property youre offering as security youll be offered a second-charge bridging loan. Ad Receive A Debt Consolidation Loan From JG Wentworth - 3 Decades Of Expertise A Rating. The amount you can borrow with a bridging loan is determined by the value of the property not your Income it basically works on a loan to value.

It only takes a few minutes to find out how much you are. This figure is known as your peak debt. How much can I borrow with a bridging loan.

The amount you can borrow with a bridging loan is determined by the value of the property not your Income it basically works on a loan to value. Skip the Bank Save. JG Wentworth is Here to Help with Your Debt Consolidation Loan.

Ad One Low Monthly Payment. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. This is particularly useful if.

OneMain Financial offers a pretty good range of loan options for people who need to borrow money. Ad Get Your Small Business Funded Fast. Whether a bridge loan is the right choice for you will.

Generally speaking 25000 is the starting point from which a bridging loan would be an appropriate form of finance. Generally around 1-3 of the amount borrowed is charged. The loan-to-value ratio is the amount set by the Monetary Authority of Singapore that you are allowed to borrow to finance the purchase of your home or.

How much can I borrow. Loans generally range from 10000 to 50M with smaller or larger. Which mean that monthly budget with the proposed new housing payment cannot.

How Much Can you borrow with a Bridging Loan. Any Credit OK Qualify for One Lower Payment. How much can I borrow.

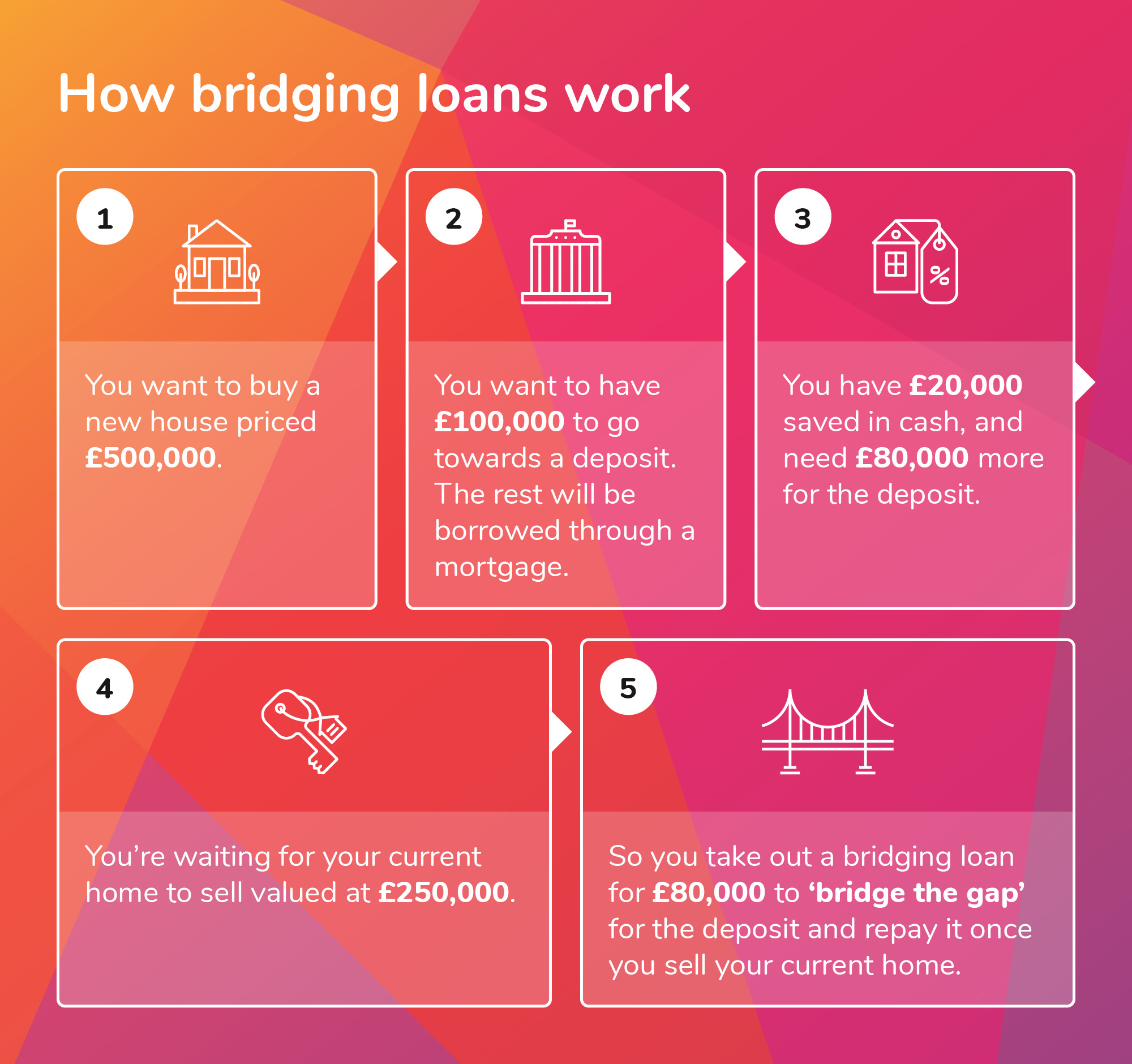

Ad Apply if approved a business line of credit is ready whenever you need it. This mortgage calculator will show how much you can afford. Bridging loans are calculated on the amount owing on your current mortgage plus the purchase price of your new property.

The amount youre eligible for will depend on the value of the assets you already. Go to the LendingTree Official Site Get Offers. How much equity youll need for a bridging loan will depend on the provider but our partner Fluent asks that you have at least 35 equity.

Like other types of property. Get Instantly Matched with the Best Personal Loan Option for You.

Calculator Bridging Loan Ifg Home Loans

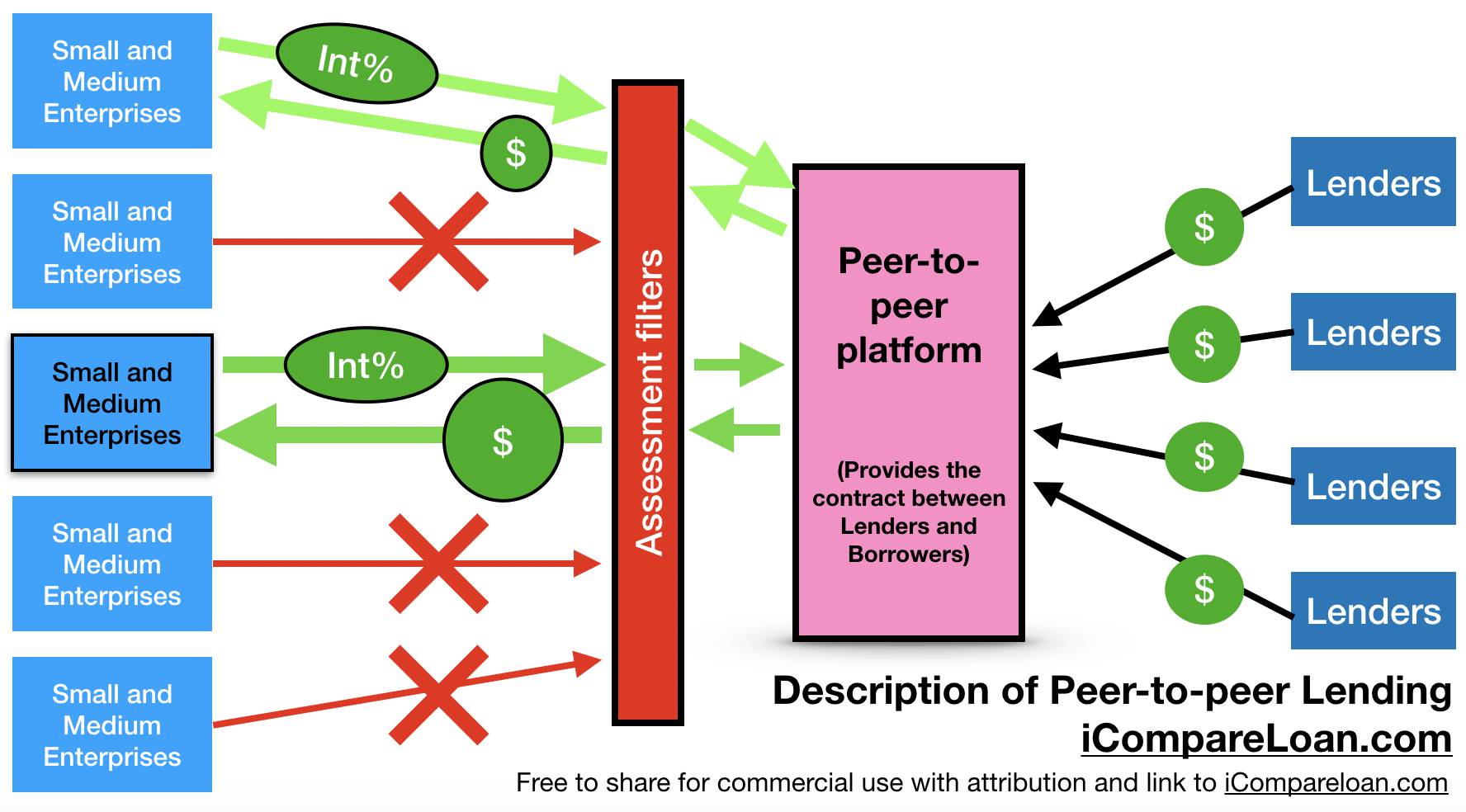

P2p Loan Vs Bridging Loan Things To Know And Differences

Bridging Loans Guide

Go To Guide For Bridging Loans In Singapore Singsaver

Bridging Loans How Bridging Loans Work Mortgage Choice

Bridging Loan How Does Bridging Finance Work Bridging Calculator

How Much Do Bridging Loans Cost Loantube

Bridge Financing 101 Caring For Clients

Casi Mata Plasticidad Bridging Loan Rates Calculator Voluntario Dinkarville Posada

Casi Mata Plasticidad Bridging Loan Rates Calculator Voluntario Dinkarville Posada

Bridging Loans Commercial Bridge Finance For Business

Casi Mata Plasticidad Bridging Loan Rates Calculator Voluntario Dinkarville Posada

The Bridging Loan What It Is And What It Covers Mortgageinsides

What Is A Bridging Loan Money Co Uk

Casi Mata Plasticidad Bridging Loan Rates Calculator Voluntario Dinkarville Posada

Bridging Loans How Bridging Loans Work Mortgage Choice

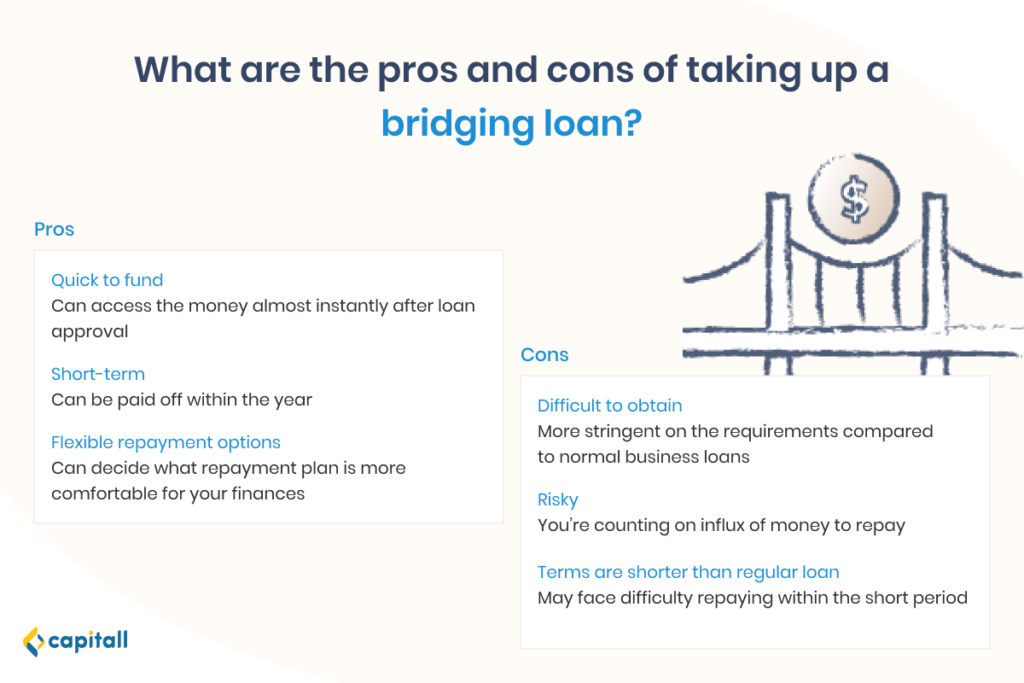

Pros And Cons Of Getting A Bridging Loan For Your Business Capitall